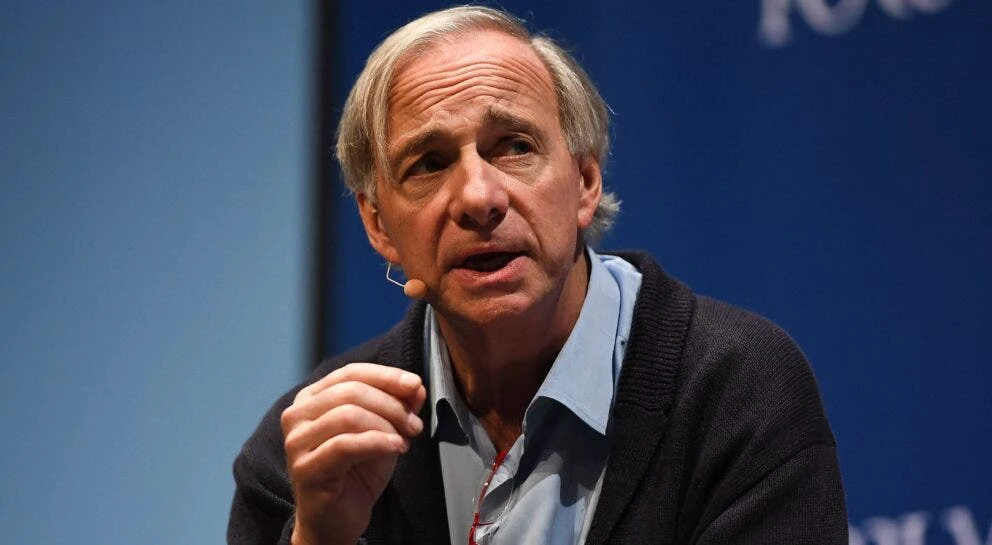

Are We In A Stock Market Bubble? Hedge Fund Guru Ray Dalio Weighs In, Sees Magnificent 7 Stocks As ‘Bit Frothy’

The U.S. stock market is not in a bubble, according to Ray Dalio, the former co-chief investment officer of Bridgewater Associates, the largest hedge fund.

Despite the market’s recent significant rallies, Dalio’s analysis suggests that the market is not exhibiting typical bubble characteristics.

What Happened: In a comprehensive analysis shared on LinkedIn, Dalio detailed the indicators he uses to spot market bubbles. These include high prices compared to traditional value measures, unsustainable conditions, an influx of new and inexperienced buyers, widespread bullish sentiment, a high percentage of purchases financed by debt, and a significant amount of forward and speculative purchases.

Dalio’s application of these criteria to the U.S. stock market led him to conclude that the market is not in a bubble. He noted that the market, on the whole, is in the mid-range (52nd percentile) and does not align with previous bubbles.

Dalio also discussed the “Magnificent 7” group of companies that have contributed significantly to U.S. stock market gains over the past year.

“The Mag-7 is measured to be a bit frothy but not in a full-on bubble,” he said. He noted that valuations are slightly high, given current and projected earnings, but he does not see excessive leverage or a surge of “new and naive buyers.”

However, Dalio noted that a significant correction could still occur, particularly if generative AI does not live up to the priced-in impact.