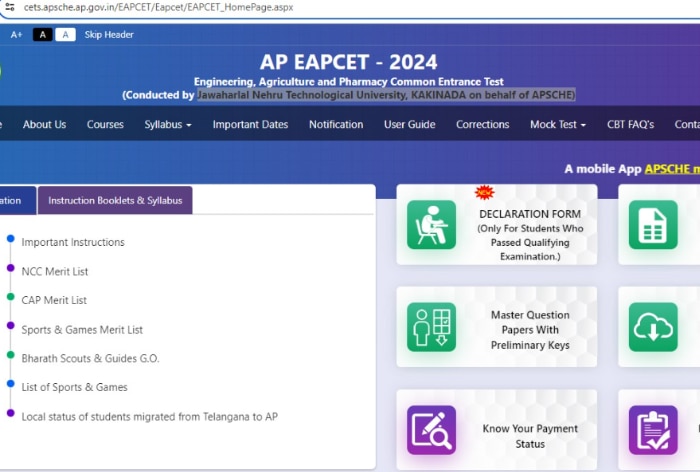

CA Vs CMA: What is the difference between CA and CMA, which one is better? Know which one has more salary and career scope..

CA Vs CMA: Choosing the better certification between Chartered Accountancy (CA) and Cost and Management Accounting (CMA) is an important decision. Both courses offer career opportunities in the financial sector, but there are significant differences between them. If you are also looking to make a career in this field, then definitely read the points given below.

Chartered Accountancy (CA)

CA certification is one of the most prestigious and sought-after courses in India. This course provides in-depth knowledge of taxation, accounting, and auditing.

Course Structure

The CA course is divided into three stages:

Common Proficiency Test (CPT): This exam can be given after passing class 12th. After passing this, one has to complete a one-year correspondence course.

Professional Competence Course: After passing CPT, one has to do an 18-month professional competence course.

Final Course: It is necessary to take the final exam after graduation.

Career Opportunities

There are various career options available for professionals working as CA, such as auditor, tax consultant, and finance manager. Along with this, the starting salary is good.

Cost and Management Accounting (CMA)

CMA certification is also important, but it mainly focuses on cost management and financial analysis.

Course Structure

The CMA course is divided into three levels:

Foundation Course: This can be started after class 10th and is for about six months.

Intermediate Course: It takes about 12 months to pass this level after the foundation course.

Final Course: The final level requires 36 months of practical training.

Career Opportunities

CMA professionals usually work in cost and financial management. There are also good career prospects for them, such as cost controller and internal auditor.

Main Difference Between CA and CMA

CA (Chartered Accountant) has very good knowledge in the fields of taxation, accounting, and auditing. Cost and Management Accounting (CMA), on the other hand, usually collects, analyzes, and interprets financial information of an organization. To get admission in the CA course, candidates are only required to pass class 12th, and after this graduate-level studies can be completed. The foundation course can be done after class 10th, but for intermediate and final examinations, passing class 12th and a graduate degree from a recognized university is required.

On the other hand, to obtain ICAI membership, it is necessary to pass the final examination as well as gain the required work experience. This exam is often considered more challenging than ICWAI. However, there is no specific qualification prescribed for membership, and it is relatively easier to obtain than CA. The job profile of a CA has varied opportunities and one usually gets a higher salary than ICWAI in the beginning. In contrast, the job profile of a Cost and Works Accountant is limited to cost and financial management, and its salary is slightly less than that of a CA.