Federal Reserve holds rates steady amid high projections for 2024 rate cuts

The US Federal Reserve has decided to maintain its benchmark interest rates at 5.25-5.50 per cent for the fifth consecutive meeting, according to an announcement made after the Federal Open Market Committee (FOMC) meeting on March 20.

Despite persistent inflation concerns, the Federal Reserve remains poised for potential rate cuts in 2024.

This decision comes amidst a backdrop of economic uncertainty and evolving projections for GDP growth and inflation.

The Fed’s decision to keep interest rates steady is an attempt to balance the objectives of maximum employment and stable inflation.

Since July 2023, the central bank has maintained rates at their highest level in over two decades.

The Federal Reserve foresees three potential rate cuts in 2024, signalling a shift in monetary policy amid ongoing inflationary pressures.

This decision aligns with expectations, indicating the Fed’s cautious approach towards economic stabilisation.

Alongside its rate decision, the Federal Reserve revised its economic projections, anticipating a stronger GDP growth rate of 2.1 per cent for the year 2024, up from the previous estimate of 1.4 per cent.

Despite maintaining the headline inflation forecast, the Fed slightly raised its projection for ‘core’ inflation to 2.6 per cent.

Additionally, the unemployment rate forecast was adjusted downward to 4 per cent for 2024.

Following the Fed’s announcement, the S&P 500 surpassed the historic 5,200-mark for the first time, signalling investor optimism.

The tech-heavy Nasdaq 100 also experienced a notable uptick.

Concurrently, bond yields exhibited a downward trend, with two-year yields declining by seven basis points and the yield on 10-year Treasuries dropping by two basis points.

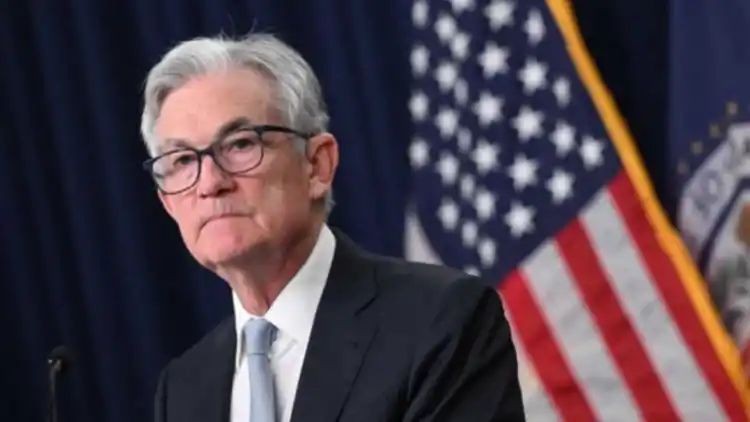

Federal Reserve Chair Jerome Powell indicated a forthcoming adjustment in the central bank’s strategy regarding the reduction of its balance sheet.

While no concrete decisions were made during the meeting, Powell emphasised intentions to slow the pace of asset sales in the near future.

This move aims to mitigate liquidity concerns and provides the Federal Reserve with greater flexibility to address economic challenges.

“While we did not make any decisions today, the general sense of the committee is that it will be appropriate to slow the pace of runoff fairly soon, consistent with the plans we previously issued,” a CNBC report quoted Powell as saying.

Despite maintaining a steady stance on rates, Powell reiterated the likelihood of initiating rate cuts later in the year, contingent upon economic data.

Market indicators suggest a 75 per cent probability of the first rate cut occurring during the June 11-12 meeting.