Rs 19/Share Dividend: Ex-Date On March 19; Buy The BSE 500 Stock?

As of Friday’s closing session, Kama Holdings Limited, a mid-cap firm, gained a market capitalization of Rs 8,019.60 Cr. Kama Holdings has business interests in education, real estate and investment through three wholly owned subsidiaries which are Shri Educare, KAMA Realty (Delhi) and SRF Transnational Holding

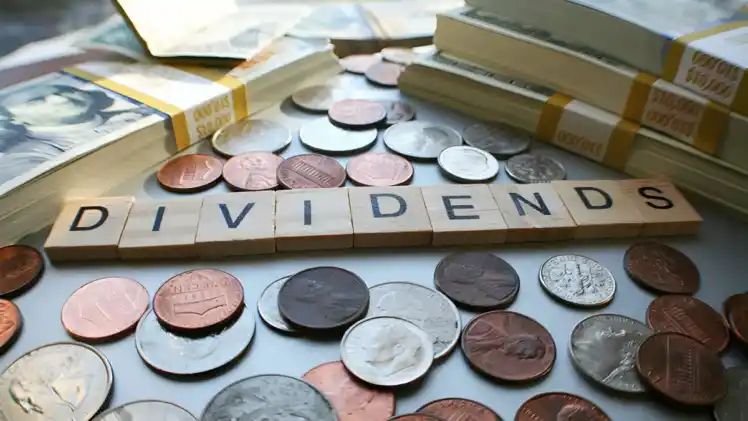

This week, attention will be on the BSE 500 stock as it will trade ex-dividend on March 19. The company has announced a 190% interim dividend at a face value of Rs 10 for FY24 and for the purpose of the same Tuesday, 19th March 2024 as the record date in order to pay the dividend whose names appear on the Register of Members and the beneficial owners on the record date.

Kama Holdings Dividend

The Board of Directors of the company in their meeting held on 11th March 2024, declared an interim dividend @ 190% i.e. Rs. 19 per share on the paid-up equity share capital of the company.

“Dividend would be paid to members whose names appear on the Register of Members and the beneficial owners as per details received from National Securities Depository Limited and Central Depository Services (India) Limited, as on the Record Date i.e. Tuesday, 19th March 2024 which has already been communicated to Exchanges by letter dated 04th March, 2024. The date of payment of interim equity dividend will be Tuesday, the 09th April, 2024,” said Kama Holdings in a BSE filing.

180% Dividend: Bet On The Chemical Stock Ahead of Record Date On 19th March?

Kama Holdings Financials

On a standalone basis, the company reported net sales of Rs 8.49 crore in the December 2023 quarter up 12086.8% from Rs. 0.07 crore in the December 2022 quarter. Its quarterly standalone net profit stood at Rs. 5.31 crore in Q3FY24 up 2680.89% from Rs. 0.21 crore in Q3FY23 whereas its EBITDA reached Rs. 7.12 crore up 2737.04% from Rs. 0.27 crore in the same quarter of the previous fiscal.

The company’s consolidated net sales for the December 2023 quarter were Rs. 3,075.83 Cr, a 12.2% drop from the year-ago quarter’s of Rs. 3,503.23 Cr. Its EBITDA was Rs. 589.07 crore, down 31.49% from Rs. 859.77 crore in the same quarter of the previous fiscal year, while its quarterly consolidated net profit was Rs. 129.15 crore in Q3FY24, down 52.43% from Rs. 271.50 crore in Q3FY23.

Kama Holdings Share Price Target

“Kama Holding, the notable core investment company, is currently trading at nearly ⅕ PE ratio against its sector’s ratio of 55 while also delivering a higher dividend compared to its peers. However, the stock trading at the 2500 level could appear bearish below 2410. In case the stock’s price breaches below its key support level at 2410, the market may witness a decline in its range of 2320 and 2200 soon after. In this case, I urge traders to monitor the price momentum closely before any decision. Those seeking short-term gains and planning to tap into the current ‘Buy on Dip’ opportunity should wait for the stock’s price to break out above the 2550 level before they initiate any fresh long positions. Post breakout, traders can anticipate target levels between 2580 and 2600 while following a strict stop loss at 2460,” said V.L.A. Ambala, a Research Analyst (SEBI Registered), Co-founder – Stock Market Today (SMT).

Disclaimer

The recommendations made above are by market analysts and are not advised by either the author, nor Greynium Information Technologies. The author, nor the brokerage firm nor Greynium would be liable for any losses caused as a result of decisions based on this write-up. Goodreturns.in advises users to consult with certified experts before making any investment decision.

Vipul Das Goodreturns

source: goodreturns.in