Sensex trades flat, FMCG stocks gain

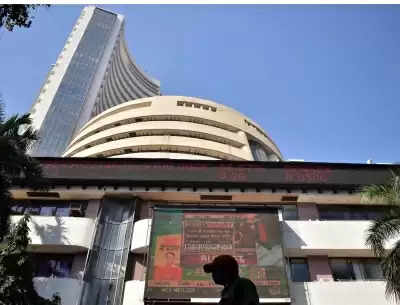

Mumbai, Sep 3 (IANS) Indian equity indices were trading flat on Tuesday following mixed sentiments in the markets.

At 9:51 a.m., Sensex was down 76 points or 0.09 per cent at 82,483 and Nifty was down 17 points or 0.07 per cent at 25,261.

The broader market trend remains positive. On the Bombay Stock Exchange (BSE), 2039 shares were trading in the green, 829 shares in the red, while 128 shares did not see any change.

Midcap and smallcap stocks were performing better compared to largecaps. The Nifty Midcap 100 index was at 59,382, up 229 points or 0.39 per cent, and the Nifty Smallcap 100 index was at 19,359, up 116 points or 0.60 per cent.

Among the sectoral indices, Realty, FMCG, metal, PSU bank, media, energy and auto are major gainers. Fin service, IT and service sector are major losers.

In the Sensex pack, Sun Pharma, ITC, M&M, Power Grid, HDFC Bank, Tata Steel, Nestle, Wipro, NTPC, Axis Bank and Tata Motors are the top gainers. Bajaj Finance, Bajaj Finserv, Infosys, Maruti Suzuki, ICICI Bank, Tech Mahindra, Maruti Suzuki, Titan and TCS are the top losers.

According to market analysts, “There are two distinct trends in the market now which can be observed in the secondary and primary markets. In the secondary market, recently, there has been a positive trend with high-quality stocks being accumulated and moving up. Bajaj Finance, ITC, Bajaj Auto and Maruti are examples of this healthy trend. At the same time, there is froth in segments of mid and small caps where valuations are hard to justify.”

“The other trend is the irrational moves in the SME IPO market where many SMEs of doubtful credentials are getting their IPOs oversubscribed many times and the stocks on listing are manipulated and driven to upper circuits for days,” they added.

Most Asian markets are trading in the red. The markets of Tokyo, Shanghai, Hong Kong, Seoul and Jakarta are bullish. At the same time, the Bangkok market is in the green. US markets were closed on Monday due to Labor Day.

The foreign institutional investors (FIIs) extended their buying as they bought equities worth Rs 1,735.46 crore on Monday, while domestic institutional investors bought equities worth Rs 356 crore on the same day.

–IANS

avs/uk